Our services

Insurance Agency Valuations

An industry-trusted source for valuing insurance brokerage firms

There are many reasons agents obtain a third-party valuation. As an M&A advisor, our expertise is in knowing the market value of independent insurance agencies and brokerages. We’ve negotiated with hundreds of buyers around the country, have been hired to evaluate agencies on behalf of buyers, and provided valuations to most lenders in the industry. As such, we know the market value of insurance agencies better than just about anyone. Our team of certified business valuators completes over 20-30 valuations every month. For our seller clients, this depth of insight helps us to deliver the highest price for their agency the market will provide.

Why Enlist Our Help with Your Insurance Brokerage Valuation?

Over 200 valuations performed each year for firms producing an aggregate of more than $2B in annual premiums.

Over 200 valuations performed each year for firms producing an aggregate of more than $2B in annual premiums. Experience in evaluating retail agencies, wholesale brokerages, MGAs/MGUs, IMOs, and insurance networks.

Experience in evaluating retail agencies, wholesale brokerages, MGAs/MGUs, IMOs, and insurance networks. Proprietary database of more than 400 completed agency sale transactions.

Proprietary database of more than 400 completed agency sale transactions. Team of certified business valuators.

Team of certified business valuators. Fastest valuation turnaround time in the industry and competitive pricing.

Fastest valuation turnaround time in the industry and competitive pricing.

Frequently Asked Questions About Valuing an Insurance Business

Please review our frequently asked questions about insurance business valuations below. Have more questions? Fill out the form at the bottom of this page for further guidance from our certified business appraisers.

Why should I use Agency Brokerage to value my agency?

We have multiple, certified business appraisers on staff. Our team has evaluated thousands of insurance agencies and brokerages and has been involved in hundreds of M&A transactions, giving us real insight into the marketplace. We are also the go-to valuation source for some of the industry’s top lenders.

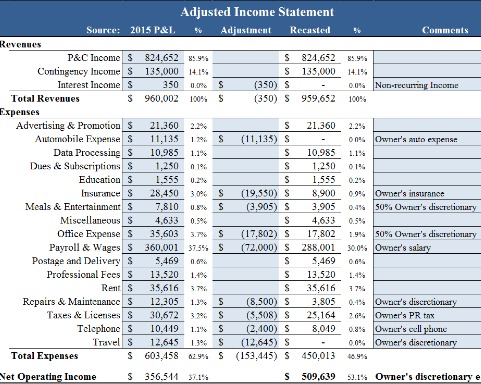

How is the value of my insurance agency determined?

The value of an agency is based on a variety of factors including (1) the quality of the book of business, staff, and systems, (2) the size of the agency, (3) the agency’s organic growth rate, and (4) the pro forma EBITDA. The purpose of the valuation engagement often dictates financial adjustments and the methods that are used. Valuing the agency to determine market value is different from valuing for a shareholder buyout which is different from valuing for an ESOP, etc.

What documents are needed for a business valuation?

Documents required for a business valuation typically include financial statements (income statements and balance sheets), internal production reports, carrier reports, and employee data, to list a few key items. We will typically need 3 to 5 years of data.

What factors are taken into account when valuing an agency?

After reviewing the data that is provided and having a discussion with agency management, we evaluate such factors as the agency’s (1) history, (2) location, (3) growth strategies and opportunities, (4) data and management systems, (5) employees and producers, and (6) concentration of business with carriers, customers, and lines of business.

Articles to Help You Understand What Your Insurance Agency is Worth

Get Started Today

Fields marked (*) are required