Agency Valuations – The Truth About EBITDA Multiples

I’ve come across a few articles posted by agency valuation consultants challenging the use of EBITDA multiples in valuations. It can be argued that EBITDA is not a measure of true cash flow. It can be argued that such a valuation method ignores intrinsic factors of an agency. Here’s the problem with those arguments: Buyers and their financiers talk about EBITDA multiples and, when you’re trying to understand the market value of an agency, those are the only two groups that matter.

What is EBITDA and How is it Calculated?

For mid-sized to larger agencies, EBITDA is generally as the acronym describes: Earnings Before Interest, (Income) Taxes, Depreciation and Amortization. Usually larger agencies have clean financials and the owners are drawing market rate compensation, so there tends not to be very much fluff flowing through the income statement.

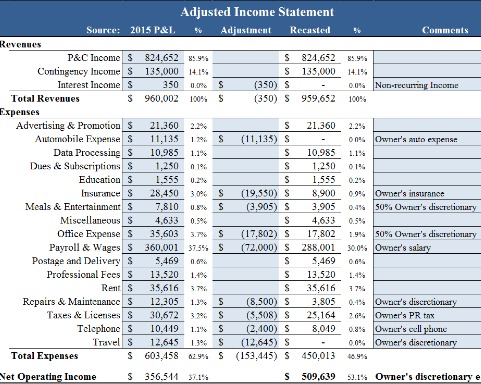

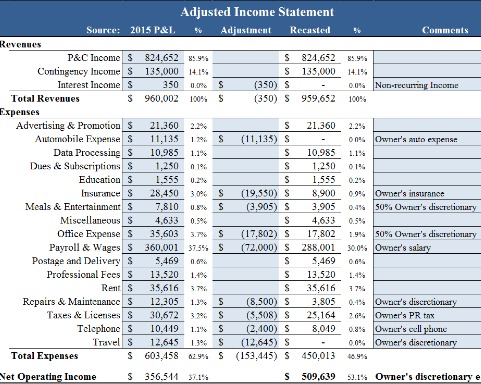

For smaller agencies though, particularly those with a single owner, the EBITDA calculation involves more analysis and is what we call an “adjusted EBITDA” due to the fact that there are typically a number of adjustments to remove the owner’s personal expenses. We like to call this “undoing the owner’s tax strategy” and, on occasion, the tax strategy can be pretty extensive. The analysis could look something like the following:

It is important to note that the owner’s discretionary earnings are NOT the same as EBITDA. This is often a point of misunderstanding and disagreement between agency owners and buyers. I’ve even seen valuations from certified appraisers that pair the wrong earnings and earnings multiple (e.g. using an EBITDA multiple on DE or P/E multiple on EBITDA).

The goal is to project the buyer’s pre-debt, pre-tax earnings after paying all expenses including the cost of replacing or retaining the owner. The replacement cost could be equivalent to a manager’s salary, a percentage of the owner’s book of business if they need to transfer accounts to a producer, or a combination of both, depending on what the owner(s) do in the agency.

Further to the point, when dealing with a specific buyer, the EBITDA calculation becomes a “pro forma EBITDA”. Most likely, the buyer is not going to show you their synergies, which can be revenue enhancement from better carrier contracts or expense reductions due to job redundancy. Many larger buyers however will want to cushion the EBITDA with corporate overhead expenses, usually a few percentage points on revenue, will need to increase employee compensation to match their corporate level and will add a compensation package for the owner(s) to keep them on-board for a negotiated period. The end result is a pro forma EBITDA number that can be much less than the owner’s calculation, possibly by 10-15% of revenue.

So in my previous example where the owner has calculated their earnings at $509,639, they might be inclined to value the agency at 6 x earnings or roughly $3M, because someone told them that was the going rate. A buyer might add in $150,000 in administrative expenses and come up with a pro forma EBITDA of $353,639. Valuing the agency again at 6 x yields $2.1M; a 30% discrepancy from the owner’s valuation. This doesn’t happen frequently but it does happen.

Why Value on EBITDA Multiples?

In simple terms, the inverse of an EBITDA multiple is the pre-tax, pre-debt return on investment since capital investment in an agency, related to the depreciation expense, is minimal. For example, a five-times EBITDA valuation yields an expected ROI of approximately 20% (i.e. 1/5). The multiple a buyer is willing to pay is driven by a number of factors including the market competition, perceived risk of the revenue and earnings, which has multiple elements unto itself, cost and availability of capital, and potential synergies.

Historically speaking, the market value of an agency as a function of pro forma EBITDA multiple is a sliding scale that increases with the size of the agency. Typically, a small insurance agency is valued at 4-6 x pro forma EBITDA, a mid-sized agency is valued at 6-8 x pro forma EBITDA and a large agency is valued at 8-10 x pro forma EBITDA. In today’s market though, extraordinary valuations are almost common place.

Earn-Outs and Extraordinary Valuations

I’ve noted a number of times that valuations are running at historic highs. The competition across the board is high because the buyer pool has swelled in recent years, in large part due to the capital markets (i.e. low interest rates and low returns on alternative investments). Agencies that may have received offers at 6-7 times EBITDA in the not-so-distant past are seeing offers at 8-9 times.

So how do these buyers make such higher valuations work?

- The portion of value above a normal amount is based on an earn-out over 2-3 years (i.e. it’s not guaranteed). For clarity, an earn-out is a payout based on future performance.

- The earn-out might include growth targets; what looks like 8-9 times on paper could effectively be 7-8 times the agency’s EBITDA at the end of the earn-out.

- The earn-out might include a claw-back where the price is adjusted downward if the target EBITDA is not maintained (e.g. $7 of price per $1 of EBITDA shortfall).

- The agency owner is incentivized to find fold-in acquisitions, which are generally at a lower multiple, and may receive credit on the earn-out for the acquisitions.

- The buyer realizes revenue and expense synergies through the acquisition that are not reflected on the pro forma.

- The buyer is growing at such a rapid pace that their valuation multiple is increasing each year, which is important to private-equity backed brokers that recapitalize PE partners every 4-6 years.

In Summary

Valuing an insurance agency on a multiple of pro forma EBITDA is a valid approach primarily because nearly every buyer uses it. The key is to understand how EBITDA is to be calculated and the structure of the payout on a potential purchase price.

Experts in Insurance Distribution Business Valuation, Sale, and Acquisition

We deliver superior results through our industry expertise, transaction expertise, and professional network.

Contact us