Implications of the 2024 Election on Taxes and the M&A Market

It’s a presidential election year and tax rates are back on the table. The most recent Quinnipiac Poll has Biden and Trump in a dead heat. Both candidates are under various legal/ethical investigations too so who knows how this election will play out.

Trump, for the most part, is proposing to retain the current tax rates, desiring to make his 2017 Tax Cuts and Jobs Act permanent, so the question is what changes might we see with a 2nd term for Joe Biden? Despite ramping up the IRS budget and auditing force, Biden failed to gain momentum with his tax policies during his first term. Nevertheless, raising taxes are front and center of his re-election campaign and some of the administration’s proposals are eye-watering.

Quoting the Tax Foundation: “The increase in the corporate tax rate and the additional taxes on top earners would result in U.S. top marginal tax rates on income that are among the highest in the developed world.”

How the Biden Administration Will Impact Taxes and the M&A Market in 2024

Some key tax changes in the Biden administration’s plan that affect business owners:

- Tax long-term capital gains at ordinary income rates for taxable income over $1M.

- Expand the Net Investment Income Tax to include non-passive business income and raise the rate to 5% on income over $400k.

- Raise top individual income tax rate to 39.6% on income over $400k ($450k for joint filers).

- Raise corporate income tax rate from 21% to 28%.

- Tax carried interest at ordinary income rates for people making over $400k.

- Tax unrealized capital gains at death above a $5M exemption ($10M for joint filers).

Let’s talk about the implications of #1 and #2 for business sellers:

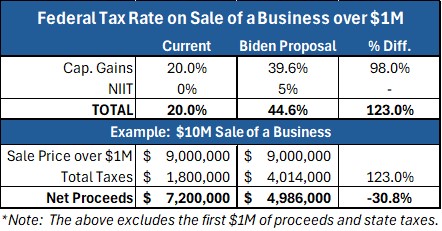

The federal long-term capital gains tax rate for gains over $1M is currently 20%. Under Biden’s plan, gains over $1M will be taxed at ordinary income tax rates, which under the administration’s plan would be 39.6% for income over $1M. Ergo, any gain over $1M from the sale of a business would face double the current federal tax rate.

Currently owner-operators of businesses are exempt from the Net Investment Income Tax (a 3.8% tax on long-term gains from passive investments) when they sell their business. Under Biden’s plan, owner-operators of businesses will have to pay the NIIT rate when they sell a business, and the rate will increase to 5%. Taken in conjunction with #1, business sellers will face federal taxes of up to 44.6% on gains over $1M from the sale of a business. Let me summarize with an illustration:

Now, let’s talk about the implications of #4 and #5 on business buyers:

While most small businesses are organized as pass-thru entities, many of the larger acquirers are not. Under Biden’s plan, C corps face a 33% increase in income taxes, which will reduce the cash these companies generate net of taxes and the overall rate of return of investments into M&A.

“Carried interest” refers to profits paid to private equity, venture capital and hedge fund managers. Currently, carried interest is taxed as a long-term capital gain (up to 20% federal rate). Under Biden’s plan, carried interest income over $400k will be taxed at ordinary income tax rates (potentially up to 39.6%, double the current rate). Given the impact that private equity has had on M&A activity and business valuations, doubling the tax rate on fund managers would presumably result in downward pressure on the value of small businesses.

Lastly, let’s talk about the “death tax”:

The 2017 Tax Cuts and Jobs Act doubled the lifetime estate and gift tax exemption, which is $13.6M ($27.2M for joint filers) in 2024. The Tax Cuts and Jobs Act sunsets in 2025, which means that the exemption will drop by 50%. Under Biden’s plan, the exemption would fall even further to $5M/$10M.

If your estate exceeds the $5M/$10M exemption, then your is estate is facing a multi-million dollar tax increase. You may want to get in front of tax planning this year, otherwise your heirs could end having to sell assets to pay the 40% death tax.

The Bottom Line

We won’t know the outcome of the presidential election until later in the year. It is also highly unlikely that President Biden, if re-elected, would be able to pass every part of his tax policy.

Nevertheless, as proposed, Biden’s policy would be disastrous to business owners and the M&A market. Both buyers and sellers would face massively higher taxes, which will deter M&A activity – forcing owners to delay selling their business, possibly for years, and driving down returns for acquirers.

I hate taxes like everyone else and hope none of these proposals come to fruition. As the saying goes though, a strong offense is the best defense so now is the time to get in front of the potential tax tsunami. The clock is ticking. Call us if you want a confidential consultation.

Posted by:

Posted by: Michael Mensch, Founder and CEO

Direct: (321) 255-1309

Experts in Insurance Distribution Business Valuation, Sale, and Acquisition

We deliver superior results through our industry expertise, transaction expertise, and professional network.

Contact us