Projecting Cash Flow from an Agency Acquisition

In my post from October, I discussed debt coverage ratios and EBITDA multiples. Now let’s talk about projecting cash flow. I’m shocked at how many buyers make offers without figuring out what the cash flow will be with financing. I’m not alone, either. I’ve spoken with many loan officers that deal with the same issue. This article is long overdue.

Step 1 – Build a Pro Forma Income Statement

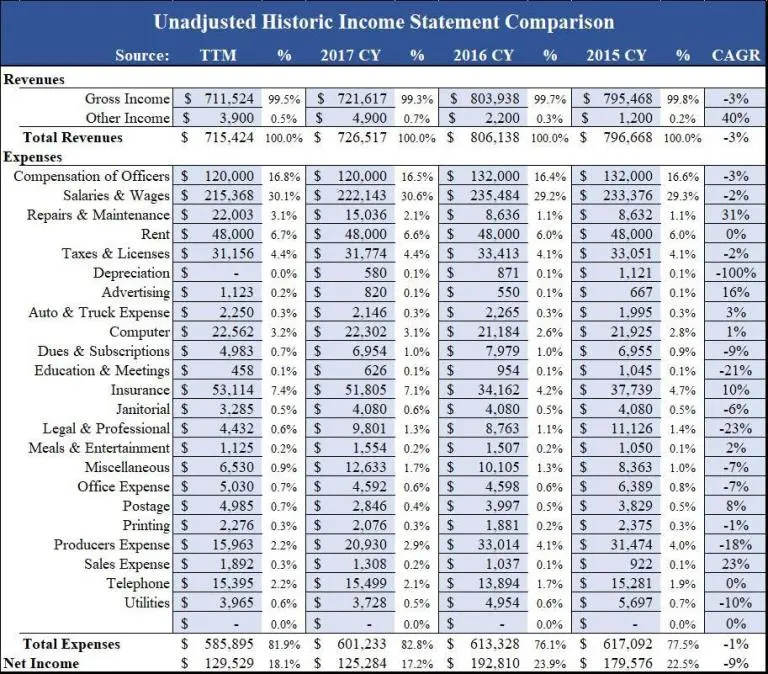

When we do a valuation, we first look at a 3 to 5-year trend by lining up the income and expenses, such as below. You’ll want to create a pro forma off of a recent trailing 12 month (“TTM”) income statement. The main purpose of lining up the historic financials is to gauge how reasonable the income and expenses on your pro forma are based on past trends.

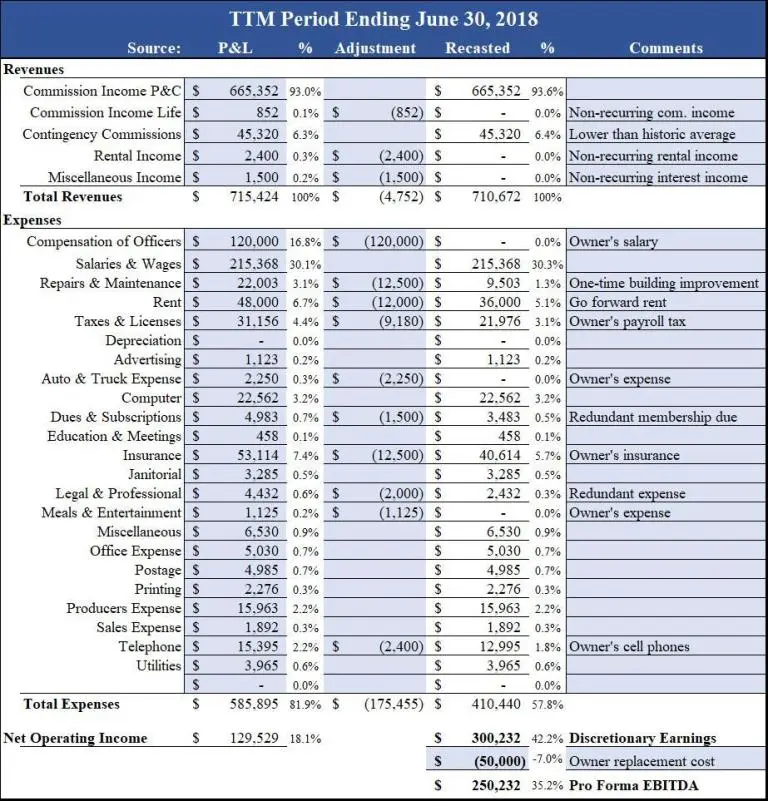

Next, you’ll make adjustments based on post-close changes and realistic income and expense projections. I’ll emphasize realistic because I’ve seen ridiculous adjustments presented by sellers, buyers, and even lenders, such as going from a 30% historic EBITDA margin to a 60% pro forma margin. Certainly, you can cut expenses but expect a deterioration of revenue if you do it dramatically. Don’t forget to budget in compensation to replace the current owner. The resulting cash flow is your pro forma EBITDA, which might look like the example below. A strategic acquisition might yield other revenue and expense synergies, but I would caution against being overly optimistic. The national brokers generally expect a 30-40% EBITDA margin, and that’s probably a realistic, sustainable margin for an average agency.

Step 2 – Calculate Your Annual Debt Service

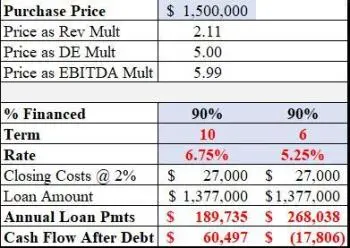

Next, calculate your annual debt service, i.e. the total annual loan payments towards the acquisition. Excel is handy for this one. Open Excel and enter the formula “=PMT(a/12, b*12, c)” where ‘a’ = the annual interest rate, ‘b’ = the number of years the loan is amortized, and ‘c’ = the amount borrowed. If you have more than one loan, such as one note with a bank and another with the seller, then add the numbers together. If borrowing money from a lender, factor in 1-2% of the loan amount as additional closing costs.

I’ve known some active buyers that ended up having to either refinance or sell due to a cash flow squeeze from shorter-term financing. The ones that refinanced would have had to sell, too, if they hadn’t found a lender willing to amortize the debt longer. As I demonstrated in my last blog post, short-term financing simply does not work with the current market prices.

Let’s assume you negotiated a $1.5M purchase price on the agency represented in the previous pro forma. That is roughly 2.1 times revenue, 5 times the owner’s discretionary earnings, and 6 times the pro forma EBITDA. Let’s assume you want to borrow 90% of the purchase price and have two options on bank financing, one offering a 10-year term at 6.75% and another offering a 6-year term at 5.25%.

Is the resulting cash flow positive or negative for your deal (not my example)? Lenders will want to see at least a 125% debt coverage ratio (pro forma EBITDA/total annual loan payments); however, they may consider all of your income for purposes of debt coverage, so you might be able to do the deal even if the target acquisition doesn’t cash flow positive.

Step 3 – Estimate Cash Flow After Debt and Taxes

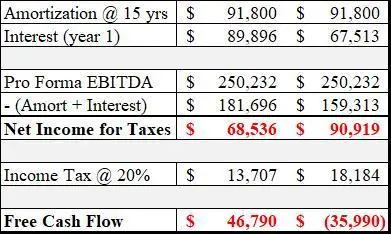

Very few buyers think about taxes. Income taxes become a real problem with shorter-term debt, though. Aside from tighter cash flow on shorter-term financing, income taxes are an issue because the IRS only allows you to write off the interest portion of payments annually, and you have to amortize the intangible assets, which are most of the purchase price allocation for an insurance agency acquisition, over 15 years. The result is that you can end up paying income tax on more income than the business actually cash flows. Let’s continue our previous examples:

So even though the 6-year term financing had a negative cash flow after loan payments, the net income that would be reported to the IRS was $95k, and the income tax was higher than for the case of the 10-year financing, resulting in an even larger deficit! If you do elect for shorter-term financing, you’ll want to conduct a very thorough due diligence and be hands-on through the transition of ownership because your margin for error will be razor thin.

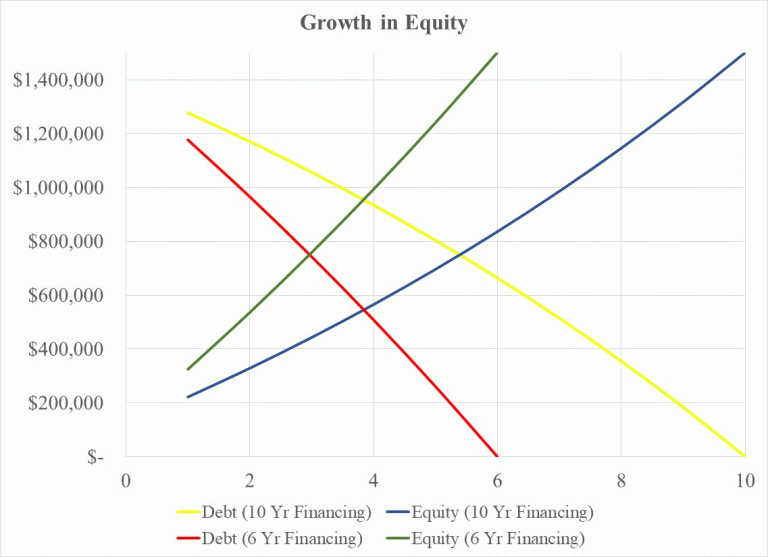

Before moving on, I will point to the obvious reason buyers elect for shorter-term financing. In addition to the lower interest rate common with the shorter term, the build-up of equity is much faster. The chart below depicts this, although I assume flat inflation and no changes to the market value of the agency (for simplicity).

Step 4 – Project Monthly Cash Flow

Another often overlooked aspect of a deal is the monthly cash flow. The P&C industry has few peers in terms of revenue predictability; however, the average agency does have revenue fluctuations month-to-month over the course of a year. Commercial agencies often experience it a little more profoundly if they specialize in certain lines of business where the clients have seasonal business or annual budgets. When acquiring an agency, you should be more sensitive to revenue fluctuations because you’ll have to cover monthly loan payments on top of regular expenses.

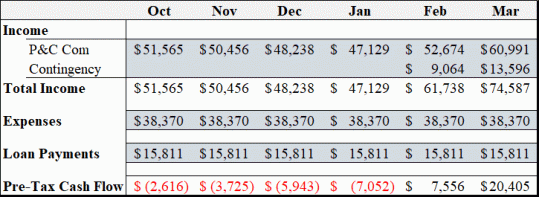

Let’s take the example of the deal with 10-year financing and assume you close in September. Most personal lines agencies see revenues dip slightly in the winter months so although the commissions may average $55k per month for the year, the actual revenue could be less. If part of the agency’s income is from contingency bonuses, those generally are not received until Spring. As a result, your first 6 months cash flow may look something like this:

For purposes of this projection, you’ll want to use the monthly revenues for the past 12-24 months as a guideline. While you may not have the ability or desire to make significant changes in the first few months of ownership, you might be able to structure the deal to give yourself a cushion. Most lenders will offer 6 months of interest-only payments. That alone would flip the cash flow from negative to positive in the example above. Lenders offer interest-only periods because they understand the transition of ownership takes time and can be a little rocky in the beginning. The second option would be to borrow additional working capital, so you have enough reserves to get through the first 6 months. Beyond those two options, you can try to push the deal back a few months, but you might risk losing the deal if the seller loses patience.

Hopefully, you gleaned some tips on deal planning from this post. To recap, when analyzing a deal:

- Collect 3-5 years of financial data.

- Build a pro forma and incorporate realistic adjustments.

- Calculate the debt service based on different financing options.

- Estimate what the income taxes will be based on your pro forma and loan terms.

- Project out monthly cash flows from the day of closing based on historical trends and factoring in your loan payments.

If you do all this, not only will you be more successful with your acquisition, but your lender will have much more confidence in your acumen as a buyer.

Posted by: Michael Mensch, CBI, M&AMI and Managing Partner

Experts in Insurance Distribution Business Valuation, Sale, and Acquisition

We deliver superior results through our industry expertise, transaction expertise, and professional network.

Contact us