Insurance Agency Profit Margins: Benchmarks, Calculations, and What’s Healthy

What Profit Margin Should an Insurance Agency Achieve—and Why It Depends?

Independent agencies typically operate with net profit margins between 15-30%, depending on the size, staffing, business model, and ownership structure. Understanding your margins is necessary to make quality management decisions, your ability to invest in growth, understand earnings available to the owner, and a key factor in agency valuation.

We’ve reviewed thousands of agency financials. While every agency is unique in one way or another, there are some general guidelines that are relevant. Most agencies operate with a profit margin between 10%-30% before taxes. There are several factors that can influence an agency’s profit margin such as the corporate structure, how much is being invested for future growth, client demographics, staffing model, technology utilization, and the owner’s ”tax strategy.”

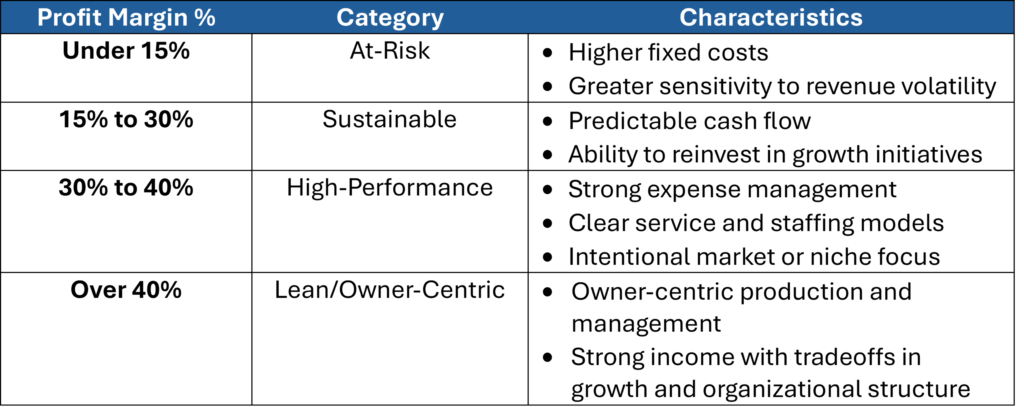

When working with independent agencies on their performance and prospective goals, here are some references I often use:

Benchmarks are a great tool for reference and context, but there are multiple aspects to an agency’s financial performance which influence where you may fall in a wide range. When consulting with agencies I do tailor a custom and unique plan based on their goals as each agency can be different. A personal lines agency which mainly produces non-standard auto policies will be drastically different from an agency that focuses on high net worth clients. Or commercial agencies who focus on small main-street businesses primarily writing BOPs operates differently from a commercial agency writing middle-market or national accounts. The staffing, client service model, technology systems, and even the corporate structure will influence how the agency performs financially.

How do Insurance Agencies Calculate Profit Margins?

What is Profit?

Most agency owners, when referencing profit, think of net income on the agency’s Profit and Loss or Income Statement. This number is often what is reported to the IRS as taxable income on your tax return each year. That’s because for most small businesses with one principal owner, net income has a direct impact on your personal income.

“Profit” is an accounting term defined as income available to the owner(s) of the company after all business revenue and business expenses have been recorded for the time period.

There are nuances that can impact how profit is reported, such as cash versus accrual methods of accounting, but the general principle is the same that profit is calculated by subtracting total business expenses from total business revenue.

Profit, Ordinary Business Income, or Taxable Income:

Profit = Total Business Revenue – Total Business Expenses

Example: $1,000,000 of Total Agency Revenue – $730,000 total Business Expenses = $270,000 Profit

In the case of a pass through entity, $270,000 is reported on the owners’ personal tax return.

Important sidenote:

Profit and cash flow are different. One of the most common questions I get when consulting with agencies is “Why doesn’t the cash in my bank account match what’s shown as profit on my income statement?”

The answer is that profit is measured from the income statement, while cash flow incorporates all transactions that impact cash reserves, including those not reflected on the income statement, such as capital expenditures and paying down loan balances. That’s why it’s important to work with a good CPA and financial consultant to understand the differences between the agency’s reported profit and any notable differences in cash flow to help create an accurate business budget.

How is Profit Margin Measured?

Profit Margin is an important key performance indicator (KPI) for how an agency performs and is represented as a percentage or ratio of revenue:

Profit Margin = Profit ÷ Total Business Revenue

Example: $270,000 Profit ÷ $1,000,000 Total Agency Revenue = 27% Profit Margin

The value of benchmarking profitability, and individual expense categories, helps an agency owner:

- Set overall goals for profitability.

- Understand the health of the business.

- Compare performance against peers.

- Gain insight into efficiency.

- Maintain a plan for growth investment and owner compensation.

- Measure shareholder return on investment.

Key Considerations for Managing Agency Profit Margins Effectively

Like most things, understanding profit and margins for your agency isn’t a one size that fits all approach. However, there are several important components to effective financial management:

- Keep timely and accurate financials so that you know what your profit margin is at any given time. Many agencies only produce profit and loss statements once per year to complete their taxes. It’s hard to manage what you don’t measure.

- Categorize your expenses so that you can effectively track, benchmark and evaluate the percentage of revenue spent in different areas. . You can’t manage expenses well when you have a dizzying array of line item expenses. Neither can you develop a reliable forecast or budget.

- Categorize your revenue sources so that you can track them and see how each contributes to profitability. Especially for agencies who earn revenue from sources like premium finance commissions or contingent commissions from carriers. While for tax purposes your profit is determined by all revenue sources, there are valuable reasons to keep track of how much of your profit each year is from revenue other than core commission and agency fees.

- Set realistic profit goals so that your business and personal goals are aligned. Some agencies function with high margins for more owner distributions with little to no equity growth, others may operate with thin margins for aggressive equity growth, and some agencies balance consistent growth while maintaining healthy margins. Creating a plan based on your personal income and business goals will guide what type of margin you should aim to achieve.

Profit margins are more than just a number on a financial statement for taxes. They are a reflection of how well your agency is structured, operated, and aligned with your personal and business goals. While industry benchmarks provide helpful context, the right profit margin for your agency depends on your niche, growth strategy, staffing model, and long-term vision. Measuring and actively managing profit allows agency owners to move from reactive decision-making to intentional leadership.

If you’re unsure whether your current margins truly support your goals – or want clarity on what’s realistic for your agency’s size and model – let’s talk.

If you’d like help evaluating your agency’s profitability, setting realistic margin targets, or building a plan that balances income, growth, and value, schedule an introductory call here.

Want to go deeper?

Check out our past webinar: Budgeting for Growth: How to Design an Annual Agency Budget That Works

Experts in Insurance Distribution Business Valuation, Sale, and Acquisition

We deliver superior results through our industry expertise, transaction expertise, and professional network.

Contact us