What is Your Agency Equity Worth? Getting a Return on Your Investment

The last few years have led to more agency principals feeling burned out. Staffing challenges, hard market cycle, client retention, and other factors are causing others to ask the question, “Should I sell my insurance agency, or should I keep going?”

Of course, the answer to that question isn’t straightforward, as there are a lot of reasons someone may be motivated to hold on for dear life (“hodl” as known in the crypto space) or sell. However, there is one question that is easy to ask but difficult to answer: Are you getting the required rate of return by owning this agency?

This article is not a guide on calculating the rate of return for an acquisition, but more for owners to get a 101 understanding of delineating the concepts of employment (what you do in/for the agency in exchange for a salary) and your equity value.

If you took Finance 101 in college or work with an advisor, the questions of risk tolerance and a target rate of return are normal. Your investment decisions should be based on your goals, whether it be income, retirement, or other.

Are you a low-risk investor and put more money in bonds? Or do you have a longer time horizon and higher risk tolerance to buy equities? It boils down to: of the options you have available, what is the best investment option for you?

Why Does Knowing Your Rate of Return Matter?

I’ve asked over 100 agency owners this question, and only a handful gave a direct answer. This problem persists for a few reasons:

- Small businesses that are owner-dependent provide good benefits of salary and profit to the owner.

- The concept of employment and equity ownership is a blurred line; therefore, it is seen as the same thing.

- Agencies are assumed to have good market value, so many principals operate under this assumption and only seek an insurance agency valuation when the need is urgent.

- Calculating the market value of a small privately owned business can be challenging, as is calculating a rate of return for the equity of that business.

What are the real effects of not being able to answer this question? Owners who assume their agency has a certain value, take all distributions available for their lifestyle, make retirement decisions (or lack of decisions) with this assumption, and then go into the selling process at or beyond retirement age, hoping to get a number good enough to retire. At that point, your timeline and options are extremely limited, and is the number one reason so many principals are working into their 70s or 80s.

Compare that to an owner who consistently reinvests into the agency with growth targets or takes distributions to invest in other appreciating or income-generating assets outside of the agency. You now have someone with little pressure and more options.

Most entrepreneurs start a business because they have confidence that they can create and build something great but taking significant risks. As an advisor, it’s my duty to ask the question, are you getting the rate of return commensurate with the risk you are taking?

What Are Your Options? Comparing Investments

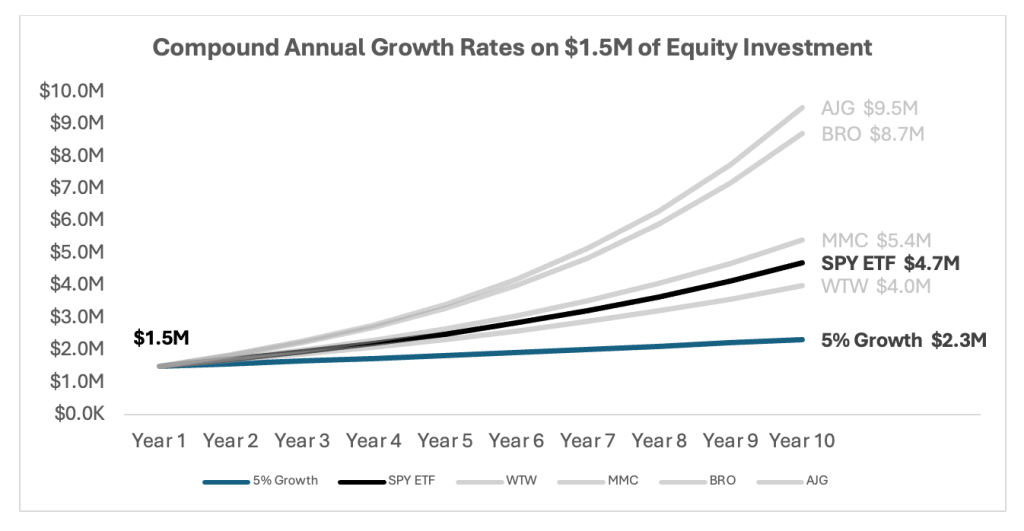

If you had $1,500,000 of equity value available today and a 10-year retirement timeline, what would you do? Hold the equity and reinvest in the agency, take every dollar of distribution possible, or cash it out and put it into an index fund or ETF with a 10-year record of 13.5% returns? (Or spoiler, the best option is a mixture.)

Of course, equity returns aren’t guaranteed, but like any investment, you assume risk and over time are compensated for that risk. But that is the difference between investing in equity compared to bonds, higher risk yields a higher rate of return over time.

A disconnect many people have is thinking that owning stocks in a brokerage account is different from owning equity in a local private company. While yes, they are different, fundamentally, the equity ownership concept is the same and should be compensated for the equity risk you take. That compensation can be either capital appreciation (growth), dividends (distributions), or a combination.

What Should the Rate of Return for an Agency Be?

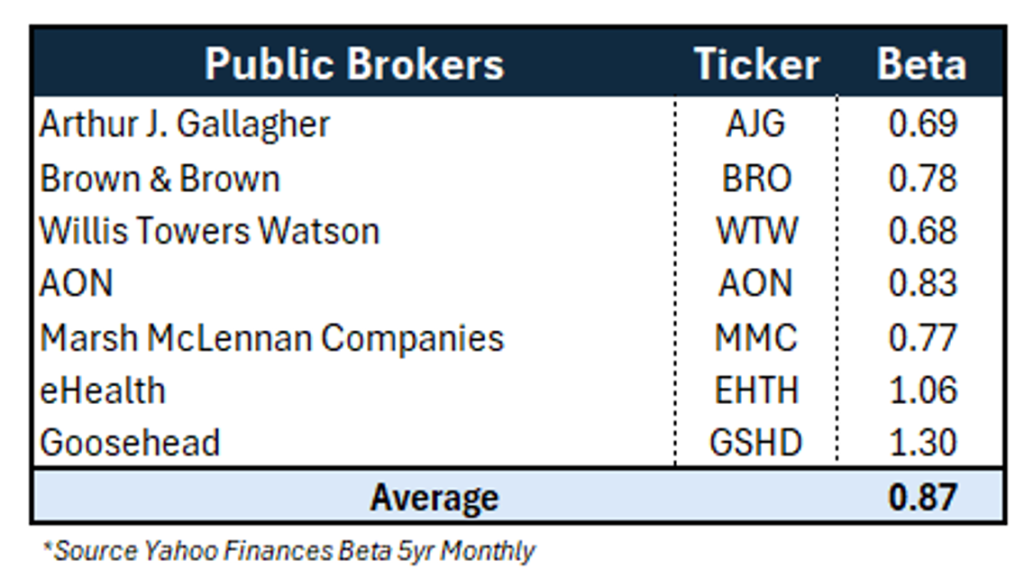

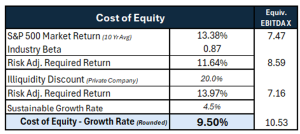

That’s up to you to decide, but some guiding principles can help with your planning. One method is to do a market return analysis and then check for reasonableness. The great news is insurance brokerages historically have a market beta of less than 1.00, which means the return relative to the S&P 500 is less risky! That can often translate to higher insurance agency market values compared to other industries. If you take the recent group average betas of the top insurance brokers, it shows a .87, which means 13% less volatility than the S&P index.

Here is an example that shows a target rate of return to an equivalent EBITDA multiple:

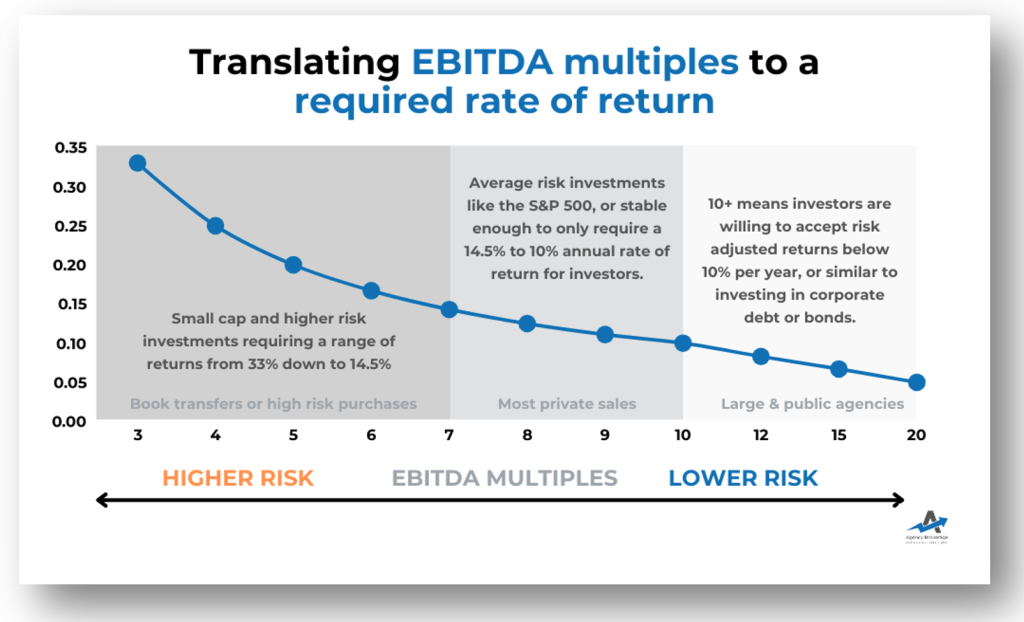

By comparison, if you translate the required rate of return to an EBITDA multiple for the 10-year S&P market return is the equivalent of 7.47. This is a reason insurance agencies are so attractive to investors, because anything above that number is saying you believe in that company more than the long-term trend of the whole market!

How You Can Measure Rate of Return in Your Agency

No private company’s annual valuation is perfect; it isn’t as simple as typing in a company ticker to see the current price on a stock exchange. The challenges for private company valuation require good financials, good operational data, and the ability to measure performance. The next step is for someone who understands the market value of your agency by using comparable transactions and relevant risk factors. This is why it’s important to work with an M&A advisor who has a current pulse on the market to understand a realistic picture of the value of your equity.

Getting an annual valuation with a reputable agency M&A firm, even if you aren’t planning to sell, is a great way to track the equity value of your agency. Each year you go through that process, you can measure the incremental change in your portfolio and review options for your exit. In a way, you can create your own stock performance chart to see how the agency performed over the time you are the owner.

Doing this helps to answer some crucial questions:

- Are the value of my assets enough for me to retire or accomplish my goals?

- What return am I earning on the equity ownership in this agency?

- Is that return sufficient, or do I need to improve sales, operations, or something else to achieve growth?

- Do I need to diversify by using income or profits from the agency to invest in other assets?

- What are my exit options?

- Is there a difference in potential values between an external (strategic) buyer and an internal (financial) buyer?

Key Takeaways

You don’t have to apply overly complex high finance concepts to operating your agency, but I do challenge you to own and manage with intentionality. There are external factors that can influence the value of your equity, but the primary driver for equity growth will be how you manage the company.

If you want to build value and exit right, there are ways you can take ownership of the process:

- Get clear on your goals. Those who fail to plan, plan to fail. Setting some realistic goals for growing the equity value of your agency is the first step to designing a plan to make it happen. It’s important to have at least a general goal regarding your exit planning for insurance agency owners because that will also guide what you need relative to where you are today.

- Steward your resources well. The transferability of your equity is critically important to maintaining its value. If you run your company with sloppy operations, poor data, and lagging information, then you can expect someone else to see it differently than you. Running a clean ship, being ready to answer questions, and being positioned for an easy handoff is a more attractive investment.

- Work with reputable advisors. Focus on doing what you do well, which is operating an agency. Maintain good relationships with other professionals who can advise on information relevant to your equity planning. A good financial advisor and tax advisor can help manage your portfolio with recommendations for your long-term planning. A good M&A advisor can help translate a realistic market value for your private company and the avenue to convert that into liquidity.

If you would like to get a complimentary valuation of your agency, or if you would like to talk about our agency CFO services to help with understanding your long-term equity value, click here to schedule an introductory call.

Experts in Insurance Distribution Business Valuation, Sale, and Acquisition

We deliver superior results through our industry expertise, transaction expertise, and professional network.

Contact us