The Tantalizing Trap of “30x EBITDA” Offers

A PE-backed firm, who I won’t name, loves to issue LOIs that say something to the effect of “The purchase price with additional Earnouts would equate to an estimated value of 30x multiple of Pro Forma EBITDA”.

Sometimes the multiple is a little higher, sometimes lower. The emphasis though is on the massive multiple … with a little footnote at the end of the sentence. When you track along the footnote, you come to a table at the end of the LOI with a dizzying array of data that shows you how YOU can get to a value of 30x EBITDA.

The offer is incredibly tantalizing as 30x EBITDA usually equates to 2.5 to 4x what your agency is actually worth. As such, many agency owners took and continue to take the bait. As my mom used to tell me though, “If it sounds too good to be true, then it probably is too good to be true.”

Pulling Back the Veil on “30x EBITDA” Offers

When you drill down on offers that propose a ridiculously high EBITDA multiple, you may notice a few things:

- The cash upfront is ~ 6 x EBITDA – i.e. not great.

- The earnout is ~ $2 for every $1 revenue growth – i.e. average.

- The earnout is paid 50% in stock – i.e. deferred liquidity and less debt for the buyer.

- Of the “30x EBITDA value”, less than 20% is guaranteed. The rest is subject to you and the buyer achieving growth that is unreasonable and/or that you can’t objectively evaluate.

- If you actually achieved the growth required to get the “30x EBITDA value”, the agency would be worth more than what they paid you.

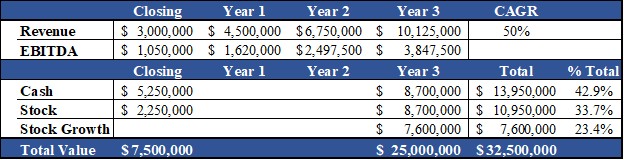

Let me illustrate it using an actual offer that was shared with me. In this example, the LOI stated “The purchase price with additional Earnouts would equate to an estimated value of 30.9x multiple of Pro Forma EBITDA and 10.8x multiple of Revenue”.

To realize the purchase price, the seller had to grow the agency at a 50% compound annual growth rate (CAGR). Here is how the projection and offer broke down (FYI: I’m adding the projection, the buyer only showed the payouts and formula. I also rounded the numbers for simplicity.):

Now, $32.5M to the owner of a $3M revenue agency is insane but is this really a good deal?

Let’s dig a little into this offer structure:

- If the agency achieved $10M revenue and $3.8M in EBITDA it would be worth in the ballpark of $45M – i.e. 40% more than the buyer would have paid.

- The agency generated nearly $8M in pre-tax profit during the earnout – yet the buyer only shelled out $14M in cash on the deal.

- Nearly 60% of the “$32.5M valuation” is tied to stock – for a firm that has not provided shareholder liquidity in over 5 years.

Its a no-lose proposition for the buyer and puts all the burden and risk on the seller. Frankly, when I see offers like this, I think I’m on the wrong side of doing deals.

Are Owners Actually Getting Paid “30x EBITDA”?

The game of positioning an offer with a ridiculous multiple worked very well for this firm over the last 10+ years. So much so, that other buyers have followed suit. The strategy of these buyers is very simple: aggregate revenue with minimal debt and golden-handcuff the principals with a material amount of equity and a big enough carrot so that they don’t leave.

We’re now 10+ years into this game. Has it worked?

Do you know of anyone that ended up with “30x EBITDA” being paid to them?

I would appreciate the opportunity to speak to someone that took one of those deals and held on to the stock. Unfortunately, I don’t know any of them personally. We advised clients to avoid those deals. But I see how many owners are selling to these firms and know the number is in the hundreds.

I have consulted with an agency owner that took a deal like this, but I was helping him to unwind it. The buyer presented an offer showing how his $7M value agency could yield $28M to him if he sold and rolled his equity into the buyer’s stock. He said to me “Mike – I knew it was a gamble but the allure was too strong.” He re-purchased the agency from the buyer a few years after the deal closed because he realized that it was smoke & mirrors and a 4x return was never going to happen… not even close. The only thing that multiplied was his regret.

The Bottom Line

My mother, and probably yours, was right – if something sounds too good to be true, then it probably is too good to be true. Unless you want to become Tantalus – the Greek mythical figure that perpetually reaches for fruit that he can never grasp, don’t fall for the trap.

If you can grow your agency at the rate required to earn “30x EBITDA”, hold on to it, control your future, and reap the reward yourself. I can promise you that buyers don’t have a magic growth wand.

Whenever or for whatever reason you decide to sell your agency, negotiate a deal where you get the highest guaranteed price. If you aren’t happy with that amount, then don’t do the deal. You’re not ready and you are just setting yourself up for strife.

“30x EBITDA” is an illusion that leads you to the torment of Tantalus – grasping for fruit that isn’t there. Be smart and see through the trick.

Posted by: Michael Mensch, Founder and CEO

Direct: (321) 255-1309

Experts in Insurance Distribution Business Valuation, Sale, and Acquisition

We deliver superior results through our industry expertise, transaction expertise, and professional network.

Contact us